Master the Accounting Equation early, it contains so much information. We will start out with the basic accounting equation and then build into the expanded accounting equation.

The Accounting Equation states that

Dr is the normal balance

Dr is the normal balance

Equal

Cr is the normal balance

Cr is the normal balance

where Owner's Equity has two components

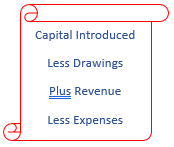

Capital is the permanent account and the Retained Earnings are the temporary accounts. Retained earnings are made up of what owners introduce into the business less anything they withdraw from the business, plus Profit (Revenue less Expenses).

Anything that increase Owners' Equity (Capital Introduced and Revenue) will have a Cr normal balance.

Basic Accounting Equation

A = L + OE

Dr Cr Cr

The basic accounting equation is

Assets = Liabilities + Owners' Equity

Where the normal balance of

An Asset is a Debit

A liability is a Credit

Owners' Equity is a Credit

We can reorganise the basic accounting equation by deducting Liabilities from both sides to give us

A - L = OE. This is also referred to as our net assets. This equation says that if we deduction our liabilities from our assets we are left with our equity.

Expanded Accounting Equation

The accounting equation can be expanded to include all the temporary accounts. The temporary accounts are what ultimately make up the Owners' Equity Capital Account.

So we can express the Accounting Equation as

Assets = Liabilities + Owners' Equity (Capital Account)

Where:

Owners' Equity is made up of the Capital Account and the Retained Earnings. The Capital Accounting is the permanent account and the only account that has a balance at the end of a period. The Retained Earnings accounts measure the movement of capital in the year. They are temporary accounts. We can express this process as the following.

Owners' Equity (Capital Account) Opening Balance + Capital Introduced - Drawings + Revenue - Expenses = Owners' Equity (Capital Account) closing Balance.

We often represent this as

A = L + OE + (CI - D + R - E)

Dr Cr Cr Cr Dr Cr Dr

Assets, Liabilities, Owners' Equity Capital, Capital Introduced, Drawings, Revenue and Expenses are referred to as Accounting Elements. One key task you must master is to be able to classify each account according to its element. We will look at that on the next page.

A bit of explanation. In the basic accounting equation OE refers to the Owners' Equity Capital Account after closing. Owners' Equity Capital Account is the one permanent account for Owner's equity. Capital Introduced, Drawings, Revenue and Expenses are all temporary accounts. And at the end of the period we transfer their balances to the Owner 'Equity capital account. We will look at this more later. The number of Owners' Equity Capital accounts will depend on the structure of the business. If the business is a sole trader there will be only one capital account. If the business is a partnership there will be one capital account for each partner.

As we have already discussed the normal balances of Owner's Equity is a Credit and so anything that increases Owner's Equity will also have a Credit normal balance. The two types of accounts that increase Owner's Equity are Capital Introduced and Revenue. The two accounts that reduced Owners' Equity (Drawings and Expenses) will have a Debit Normal Balance.